The State of Commercial Earth Observation: 2022 Edition

Demystifying The Multi-Billion $ Market* in SpaceTech

Disclaimer

This is the state of EO from my perspective - this analysis is not sponsored by any organisation or an individual. If you disagree with something or perhaps find something that is factually incorrect, please let me know. If you would like to support my efforts and help grow TerraWatch Space, please do get in touch. Thanks!

Preamble

Around a year ago, I wrote the following piece summarising my view on the Earth Observation (EO) market. It wasn’t meant to be a professional analysis. But, over the past year, it had gained a lot of attention, and as I understood, became extremely useful for folks inside and outside the “EO bubble.” I received some heartwarming messages, got to know the value it brought and led to some interesting consulting assignments. So, thank you!

Given how rapidly the EO market evolves, the infographics have become somewhat outdated. I decided to publish this edition, not only integrating some feedback I received over the last year, but also in an attempt make the piece a tad more comprehensive than before. I plan to publish the “state of EO” every year in August!

Note: As the title of the article suggests, this is an overview of specifically the commercial EO sector. There are institutional efforts from space agencies around the world who are launching some truly remarkable satellites (see WMO OSCAR for reference) and investing in building distribution and processing tools. I often write, tweet and share my insights on them, but I am not including them in this analysis.

The Earth Observation Operating Stack

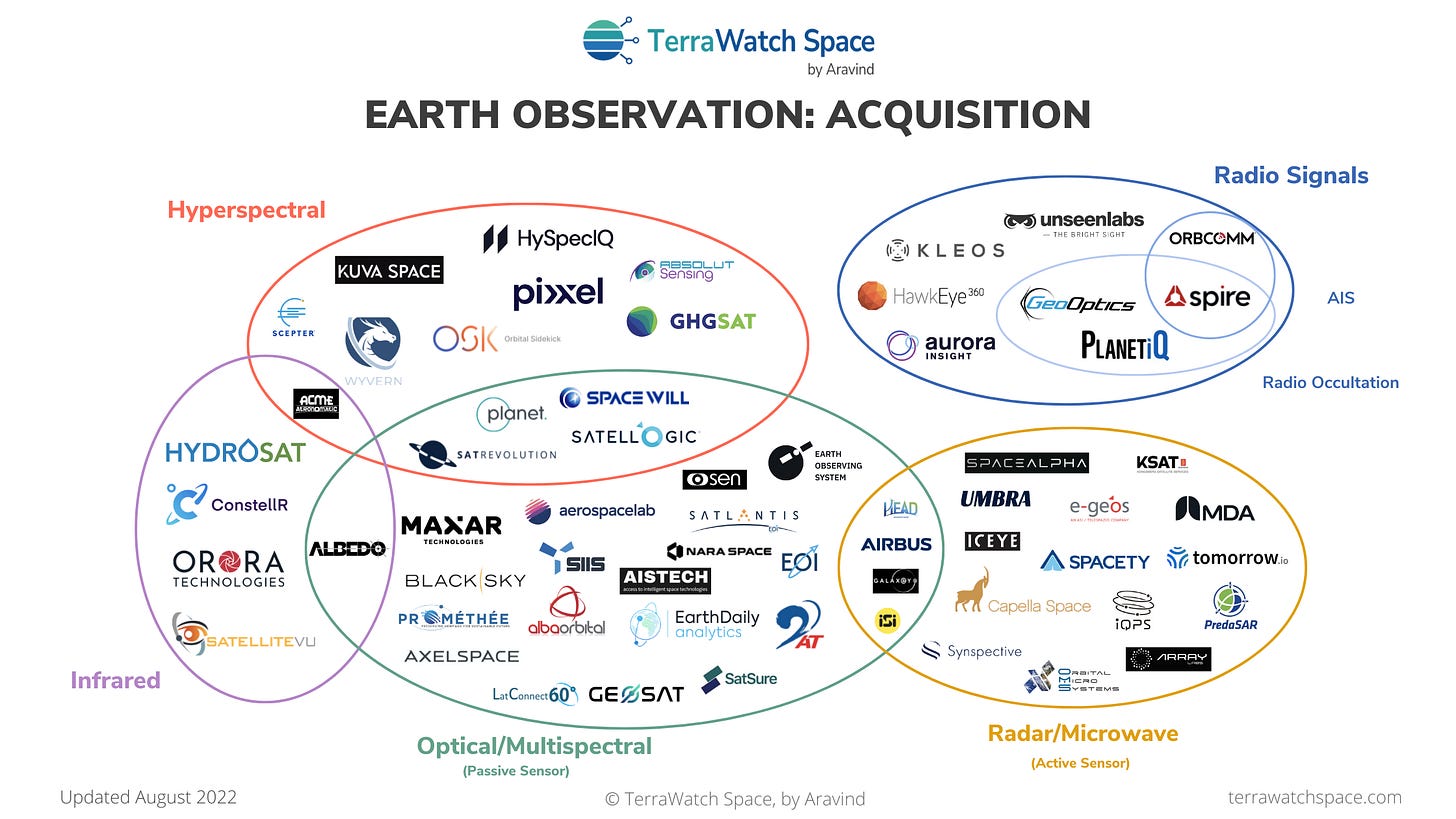

The Earth Observation (EO) market can be classified into three major layers in its Operating Stack: Acquisition, Dissemination and Intelligence.

Acquisition: The layer that has mostly everything to do with space, satellites and sensors, involved in the collection of remote sensing data from satellites.

Dissemination: The layer that is focused on making satellite data accessible, interoperable, fusable and usable, converting data into useful information.

Intelligence: The layer where the value of satellite data is realised by the users, who are happen to be situated outside the realms of the EO sector (bubble).

One of the most fundamental changes from last year’s infographic is making it vertical to highlight the evolution of the companies across the EO value chain. This is a very dynamic market and there will continue to be several moving parts.

Note: There are several other organisations whose work is crucial in moving the EO industry forward. They include many satellite data resellers such as European Space Imaging, ShadowBreak International, several EO service companies such as SparkGeo, Azavea, Development Seed, Space4Good, 4EarthIntelligence, EOX, EOMAP, Vito RS, GeoVille, etc., non-profit organisations such as Radiant Earth Foundation, Open Geospatial Consortium, Group on Earth Observations, Digital Earth Africa etc., communities such as STAC, GDAL, COG etc. and more. I am not including these groups to keep the infographic as less convoluted as possible, and focus on the privately-funded (typically VCs) and product-driven companies .

Earth Observation: Acquisition

There has been a significant boom (or a bubble?) in the formation of companies in the Acquisition layer, in the last few years. I believe that is a function of three factors:

Advancements in the space industry leading to easier access to space and increased miniaturisation of satellite systems and subsystems.

Innovative business models such as space-as-a-service and sometimes, satellite-as-a-service allowing more customers to invest in a “space strategy”

A combination of climate change, ecological crisis and evolving geopolitics that is leading to demand for more data about the planet and our activities on it.

Find below a mapping of EO companies by sensor type - I tried my best to be exhaustive, but as always, feel free to let me know if there was an omission or an error (it is possible). What makes me excited is that we are going to be acquiring more data about the planet, our life on the planet and the complex relationship between the two.

In addition to the commercial efforts, we are seeing a number of countries investing in their own Earth observation constellations, as part of their national space strategies (like UAE and Australia). Strategic interests for sovereignty and data independence as well as a socio-economic rationale for building indigenous capabilities are leading to plans for additional EO satellites from several countries. But, as mentioned before, for the purposes of brevity, I am sticking to only the commercial efforts in this piece.

Earth Observation: Dissemination

This is a new addition to the piece from last year - there has been quite a lot of activity in this layer. Often underreported and misunderstood, I believe this is fundamentally the most important piece of the EO puzzle. Why? Four reasons!

Accessibility: To not let data rot in the cloud.

Interoperability: To not build data silos.

‘Fusability’: The whole is greater than the sum of its parts, even in EO.

Usability: To make sure satellite data is analysis-ready for the user.

I categorise EO Dissemination into three layers, but couple of things to note:

The segmentation is not as black and white as it seems on the figure, given the transitory nature of these companies, and what they offer.

Most companies operating in this space can be either interdependent or independent.

As the EO industry evolves, we might start seeing larger technology companies diversifying their EO product portfolio, while smaller EO companies in the layer either trying to partner with them and/or head towards being acquired.

Earth Observation: Intelligence

I wrote about “verticalisation” last year - the trend of companies focusing on developing capabilities to solve a vertical-specific problem as opposed to offering products for solving problems across industries and use cases. We are continuing to see that across the EO sector - few EO companies launching satellites for the agriculture market, some developing products specifically for insurance customers, while there are others who continue to be operating in multiple verticals.

The categorisation of the three segments — Analytics, Insights and Applications is getting blurrier every year, and that’s inevitable. Some analytics companies are building custom applications, while some insights companies are starting to find repeatable models. Three points to note from the Intelligence layer:

The Path to the Application Layer: Some companies shall remain within their box, while others are on their way to finding that one or few use cases that will allow them to find that scalable, repeatable model.

The Go-to-Market Strategies: Apart from the usual direct to customer approach, some companies are starting to build strategic partnerships with the large consulting companies while others are building integrations into the large enterprise software companies of the world.

We Can’t Find Them All: Within the EO bubble, we shall be exposed to most companies in the Analytics and Insights segments, but we need to acknowledge that we will not be able to track down all companies in the Application layer, as they are not part of the “EO industry”, rather their own specific verticals (agtech, insurtech, climatetech etc.). And, that’s a good thing!

My Spiky Point of View: Towards an Intermediate Advisory Layer in Earth Observation

“A spiky point of view is a perspective others can disagree with. It’s a belief you feel strongly about and are willing to advocate for. It’s your thesis about topics in your realm of expertise.” - Wes Kao.

My spiky point of view is that the future of EO is dependent on the evolution of an intermediate layer. In order to make satellite data mainstream, we need the development of an “advisory service” layer that helps bridge the gap between the availability of the technology and the adoption by the majority of users.

As a technology, EO is still in the early phase with respect to its adoption. In this short lifecycle of EO technology, we have had several companies launch incredible sensors to acquire data, build amazing products to disseminate data and develop impactful products to solve problems by making sense of EO data. But, most of that has been executed with a service-oriented approach leading to project-based business models - which are not scalable. Not wrong, but not scalable, if EO needs to have the impact it can have.

So, as EO approaches the end of the early phase and the beginning of the majority phase (see graphic), the focus will shift towards product-oriented, repeatable models. And that means - moving away from one-off pilot projects towards recurring monitoring projects; moving away from EO in the foreground to towards EO in the background; moving away from satellite data towards software APIs. And, that needs to happen with a focus on solving problems for the customer.

Some customers will end up with:

a data strategy: invest in building in-house remote sensing teams to acquire data (directly from the Acquisition layer or leveraging the Dissemination layer);

a product strategy: develop an acquisition strategy to procure insights from EO-derived products (from the Analytics, Insights or Application layer);

a space strategy: decide to build a EO satellite constellation to own the data pipeline and create products for in-house consumption.

The problem? No single entity or organisation is incentivised to be holistic and objective today, except perhaps the space agencies and/or some small companies, who work on a project basis to build customised EO-driven products for organisations. As you saw from the first infographic, the global Earth observation ecosystem is rapidly growing and incredibly fragmented.

The development of the intermediate “advisory service” layer is a necessary condition for the future of EO - the availability of the technology might not be sufficient by itself. I am not quite sure if that will be several technology consulting companies (Accenture, PwC, Deloitte, KPMG, BCG, Aon etc.) integrating EO within their offering or the growth of smaller, independent ones (like my company TerraWatch Space), or EO service companies like the ones I mentioned above (SparkGeo, Azavea, Development Seed, Space4Good, 4EarthIntelligence, EOX, EOMAP, Vito RS, GeoVille etc.), but this is really what I am most looking forward to.

If you enjoyed reading this and want to support me, please share. In most cases, the distribution of the content is as important (or more important) than the content itself.

Thanks for reading!

Aravind - Founder, TerraWatch Space

Hi Aravind,

I'd like to use one of your charts in an article I am writing/updating on EO and optical filters for our company (Iridian (www.iridian.ca)). Specifically the Earth Observation: Acquisition chart - would I have your permission to use this (with reference to your article).

Please reach out to me at jason.palidwar@iridian.ca or on LinkedIn to discuss.

Thanks,

Jason Palidwar